Financial services play a crucial role in modern society, enabling individuals and businesses to manage their finances, achieve their financial goals, and drive economic growth. This blog post will provide a comprehensive overview of the financial services industry, exploring its key components, functions, and the trends shaping its future.

What are Financial Services?

Financial services encompass a broad range of activities that facilitate financial transactions and manage money. These services are provided by a variety of institutions, including banks, insurance companies, investment firms, and fintech companies.

Key Components of the Financial Services Industry

- Banking:

- Retail Banking: Provides services to individual customers, such as checking and savings accounts, loans, mortgages, and credit cards.

- Commercial Banking: Offers financial services to businesses, including loans, deposit accounts, and trade finance.

- Investment Banking: Assists companies with raising capital through activities like mergers and acquisitions, IPOs, and debt issuance.

- Insurance:

- Life Insurance: Provides financial protection to beneficiaries in the event of the insured’s death.

- Health Insurance: Covers medical expenses incurred by individuals and families.

- Property and Casualty Insurance: Protects individuals and businesses against losses due to property damage, theft, and liability.

- Investment Management:

- Asset Management: Manages investments for individuals and institutions, such as mutual funds, hedge funds, and pension funds.

- Investment Banking: Provides financial advisory services to companies and governments, including mergers and acquisitions, IPOs, and debt issuance.

- Brokerage Services: Facilitates the buying and selling of securities, such as stocks, bonds, and derivatives.

- Fintech:

- Lending Platforms: Offer alternative lending options, such as peer-to-peer lending and marketplace lending.

- Payment Processing: Facilitates online and mobile payments, such as credit card processing, digital wallets, and mobile banking.

- Insurtech: Uses technology to disrupt traditional insurance models, such as telematics insurance and on-demand insurance.

Functions of Financial Services

- Facilitating Financial Transactions: Enables individuals and businesses to conduct financial transactions, such as making payments, transferring funds, and investing.

- Managing Risk: Helps individuals and businesses manage financial risks through insurance, hedging, and risk management strategies.

- Mobilising Savings and Investment: Channels savings into productive investments, fueling economic growth and development.

- Providing Liquidity: Enables individuals and businesses to access funds when needed, such as through loans and credit cards.

- Promoting Economic Growth: Supports economic growth by providing access to credit, facilitating trade, and supporting innovation.

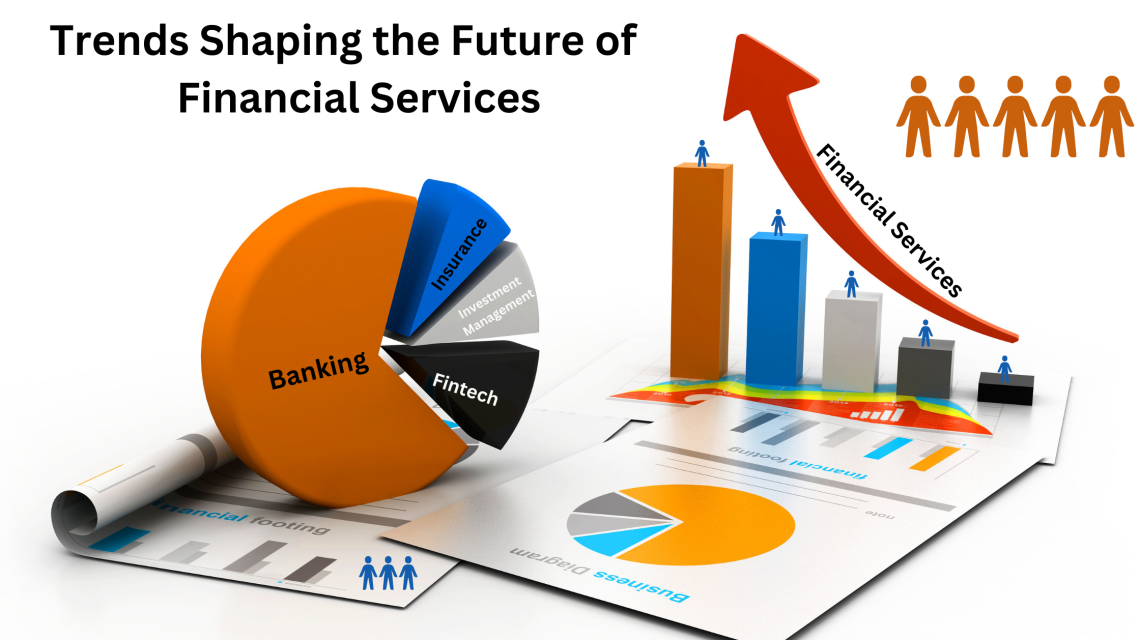

Trends Shaping the Future of Financial Services

- Digitalization: The increasing adoption of digital technologies is transforming the financial services industry. Online banking, mobile payments, and fintech innovations are disrupting traditional business models.

- Data Analytics: The use of big data and advanced analytics is enabling financial institutions to better understand customer behavior, personalize services, and detect fraud.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning are being used to automate tasks, personalize customer experiences, and improve risk management.

- Open Banking and APIs: Open banking initiatives are enabling customers to share their financial data with third-party providers, leading to increased competition and innovation.

- Regulation and Compliance: Increasing regulatory scrutiny and compliance requirements are impacting how financial institutions operate, with a focus on data privacy, cybersecurity, and anti-money laundering.

Challenges and Opportunities

- Cybersecurity Threats: The increasing reliance on technology has also increased the risk of cyberattacks, which can have significant financial and repetitional consequences.

- Data Privacy Concerns: Protecting customer data privacy is a critical challenge, with regulations like GDPR and CCPA requiring financial institutions to implement robust data protection measures.

- Competition from Fintech Companies: Fintech companies are disrupting traditional financial services models, offering innovative products and services that are often more convenient and affordable for consumers.

- Regulatory Changes: The regulatory landscape is constantly evolving, requiring financial institutions to adapt to new rules and regulations.

- Economic Uncertainty: Economic downturns and geopolitical events can create uncertainty and volatility in the financial markets, impacting the performance of financial institutions.

The Future of Financial Services

The future of financial services is likely to be characterised by continued innovation, increased competition, and a greater focus on customer experience. As technology continues to advance, we can expect to see even more innovative products and services emerging, such as blockchain-based finance, artificial intelligence-powered wealth management, and personalised financial planning tools.

Conclusion

The financial services industry plays a vital role in the functioning of modern economies. By understanding the key components, functions, and trends shaping this industry, individuals and businesses can make informed financial decisions and navigate the complex financial landscape with confidence.

Tata Infrastructure Fund :- Unlocking Opportunities in India’s Booming Infrastructure…

Tata Infrastructure Fund :- Unlocking Opportunities in India’s Booming Infrastructure…  Transforming the Future :- Tata Mutual Fund Launches New Brand Identity…

Transforming the Future :- Tata Mutual Fund Launches New Brand Identity…