India is buzzing with new ways to handle money. Digital Public You can pay for your chai with a quick scan, get a loan on your phone, and invest in the stock market without ever stepping into a bank. This isn’t magic- it’s the result of a huge change called the fintech boom.

Fintech simply means using technology to make financial services better and easier to use. India has become a leader in this area, and a big reason for this success is something called “Digital Public Infrastructure” or DPI. Think of DPI as the roads and highways for the digital world. It’s the basic stuff that everyone can use, and it has allowed many new and exciting businesses to grow.

This boom isn’t just about cool apps; it holds important lessons for other countries and for anyone interested in how technology can change lives. Let’s dive into five key things we’ve learned from India’s fintech journey.

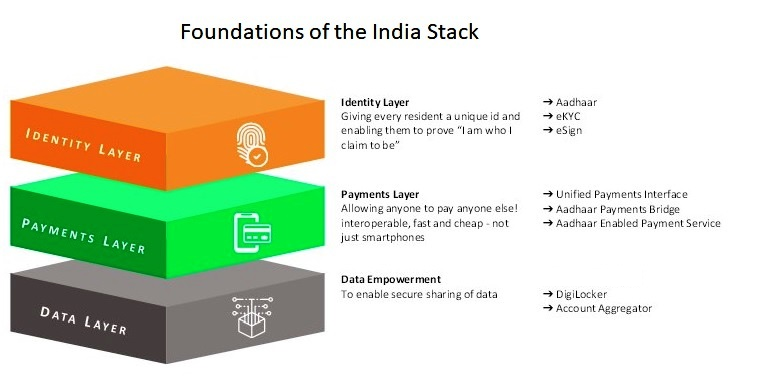

1. Building the Base – Why Digital Public Infrastructure is King

It would be slow, expensive, and difficult for people to move around. That’s what the financial world was like before DPI. Banks had their own systems, and it was hard for new companies to connect and offer different services to everyone Digital Public.

India took a different approach. It built shared, open platforms that anyone could use. Think of these like the internet itself – it’s a basic structure that allows countless websites and applications to exist. In India’s case, key DPIs include:

This is a unique digital identity for almost every resident. It’s like having a digital ID card that can be used to easily verify who someone is Digital Public.

Unified Payments Interface (UPI): This is a system that allows people to send and receive money instantly using their phones. It works with different banks and payment apps, making transactions seamless.

Account Aggregator (AA): This is a framework that allows people to securely share their financial data (with their permission) Digital Public between different financial institutions.

These DPIs are like the foundation of a strong building. Because everyone can use them, it has become much easier and cheaper for new fintech companies to start and grow.

When the basic infrastructure is strong and accessible, Digital Public the private sector can build amazing things on top of it.

2: The Power of Openness – How Collaboration Drives Innovation

In the past, the financial world was often closed off. Banks and other institutions kept their data and systems separate. This made it hard for new ideas to emerge and spread.

India’s fintech boom has shown the power of openness. Digital Public The DPIs are designed to be open to everyone. This means that different companies, big and small, can connect to these platforms and build their own services.

The Account Aggregator framework also promotes openness by allowing secure data sharing between different financial players. This enables new services like personalized financial advice and faster loan processing.

This open approach has created a vibrant ecosystem where different players can collaborate and build on each other’s strengths. Banks can partner with fintech startups, and technology companies can offer financial services. This collaboration leads to more innovation and better outcomes for consumers.

An open and collaborative environment, facilitated by shared infrastructure, fosters innovation and creates more value for everyone. Breaking down silos and encouraging partnerships can lead to exciting new possibilities.

3. User-Centricity – Designing for Everyone, Everywhere

One of the most impressive things about India’s fintech boom is how it has reached people across the country, including those in rural areas and those who were previously excluded from the traditional financial system.

This has been possible because the DPIs were designed with the user in mind. They are:

Using UPI for payments is often free for consumers, Digital Public making it accessible to everyone.

The interfaces of many fintech apps are simple and intuitive, even for people who are not very familiar with technology.

Many services work on basic smartphones and don’t require high-speed internet, making them available to a wider population Digital Public.

Aadhaar provides a digital identity to millions who previously lacked official identification, opening up access to financial services.

This focus on user needs has been crucial for the widespread adoption of fintech in India.

Companies have understood that to succeed, they need to create solutions that are relevant and easy to use for a diverse population.

Designing financial solutions with the user at the center, focusing on affordability, ease of use, and accessibility, is key to driving widespread adoption and financial inclusion.

4. The Role of Smart Regulation – Balancing Innovation and Safety

While innovation is important, it’s also crucial to have rules and regulations in place to protect consumers and ensure the stability of the financial system. India’s approach to regulating fintech has been a balancing act.

The Reserve Bank of India (RBI), the country’s central bank, has played a proactive role in creating a regulatory environment that encourages innovation while also managing risks. Some key aspects of this approach include:

Issuing Clear Guidelines: The RBI has provided clear rules and guidelines for different types of fintech activities, helping companies understand the boundaries and operate within the law.

Adopting a Progressive Stance: While being mindful of risks, the RBI has generally adopted a forward-looking approach, encouraging innovation and new business models.

This smart regulation has provided a framework for the fintech boom to flourish while also safeguarding the interests of consumers and the financial system.

A well-thought-out regulatory framework that balances innovation with consumer protection and financial stability is essential for the sustainable growth of the fintech sector.

5. The Power of Data – Fueling Personalization and Efficiency

The digital nature of fintech generates vast amounts of data. When used responsibly and ethically, this data can be a powerful tool for creating more personalized and efficient financial services.

Personalized Loans: By analyzing transaction data, lenders can get a better understanding of a borrower’s creditworthiness and offer more tailored loan products.

Customized Financial Advice: Fintech platforms can use data to provide personalized financial advice based on a user’s spending habits and financial goals.

Fraud Detection: Data analytics can help identify suspicious transactions and prevent fraud, making digital financial services safer.

The Account Aggregator framework further empowers consumers by giving them control over their data and allowing them to share it securely with financial institutions for better services.

As the use of data in fintech grows, robust safeguards must be in place to protect user information and prevent misuse.

Data is a valuable asset in the fintech world, enabling personalization, efficiency, and better risk management. Digital Public, it’s essential to prioritize data privacy and security to build trust and ensure responsible innovation.

The Ripple Effects of India’s Fintech Success

India’s fintech boom, powered by its innovative Digital Public Infrastructure, offers valuable lessons for the world. It shows how a government-backed initiative can act as a catalyst for private sector innovation, leading to greater financial inclusion and economic growth.

The success of UPI, Aadhaar, and the Account Aggregator framework is being studied by other countries looking to leverage digital technology to transform their financial systems. The focus on openness, user-centricity, and smart regulation provides a blueprint for building a Digital Public thriving fintech ecosystem.

While challenges remain, such as ensuring digital literacy and addressing cybersecurity risks, the journey so far has been remarkable. India’s fintech story is a testament to the power of vision, collaboration, and a commitment to building a digital future that benefits everyone. As the digital wave continues to grow, the lessons learned from India’s experience will undoubtedly shape the future of finance globally.

5 Ways Digital Public Infrastructure Accelerates Private Sector Innovation Opportunities and Challenges

5 Ways Digital Public Infrastructure Accelerates Private Sector Innovation Opportunities and Challenges  The Future of Enterprises: Digital Public Infrastructure.

The Future of Enterprises: Digital Public Infrastructure.  Infrastructure South Africa’s : Leveraging Private Sector Expertise.

Infrastructure South Africa’s : Leveraging Private Sector Expertise.

wonderful!

good!

super!