Tata Consumer Products Limited (TCPL), a leading player in the Indian packaged consumer goods (FMCG) sector, recently announced its financial results for the third quarter of the fiscal year 2025 (Q3FY25). While profit margins faced pressure due to rising input costs, particularly tea inflation, the company demonstrated strong topline growth, driven by robust revenue performance across key segments.

Key Highlights:

- Revenue Growth: TCPL reported a significant 16.8% year-on-year (YoY) jump in revenue to ₹4,443.6 crore in Q3FY25, surpassing market expectations. This robust topline growth was fueled by a combination of factors, including:

- Strong Volume Growth: Consistent volume growth was observed across both the beverage and food segments, indicating strong consumer demand for TCPL’s products.

- Price Increases: The company implemented strategic price increases to mitigate the impact of rising input costs, particularly in the tea segment.

- Profitability Challenges: Despite the strong topline performance, profitability faced headwinds:

- EBITDA Margin Contraction: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) declined by 1.3% YoY to ₹564.7 crore, leading to a 234 basis points contraction in EBITDA margins to 12.7%.

- Impact of Tea Inflation: Rising tea prices significantly impacted the company’s margins, posing a significant challenge to profitability.

- Flat Net Profit: Net profit remained relatively flat at ₹279 crore, impacted by higher input costs and increased operating expenses.

- Segmental Performance:

- India Business: The Indian branded business faced challenges due to escalating tea prices, resulting in a 43% YoY decline in profit.

- International Business: The international branded beverage segment delivered strong performance, with a 53% YoY increase in profit, driven by robust growth in key markets.

- Non-Branded Business: The non-branded business also exhibited strong growth, contributing to overall company performance.

Strategic Initiatives:

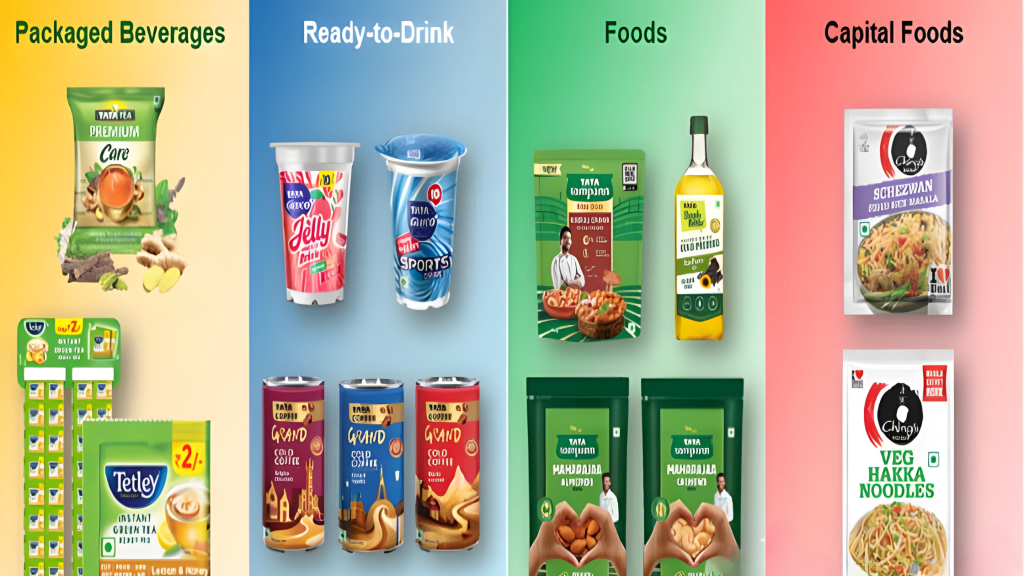

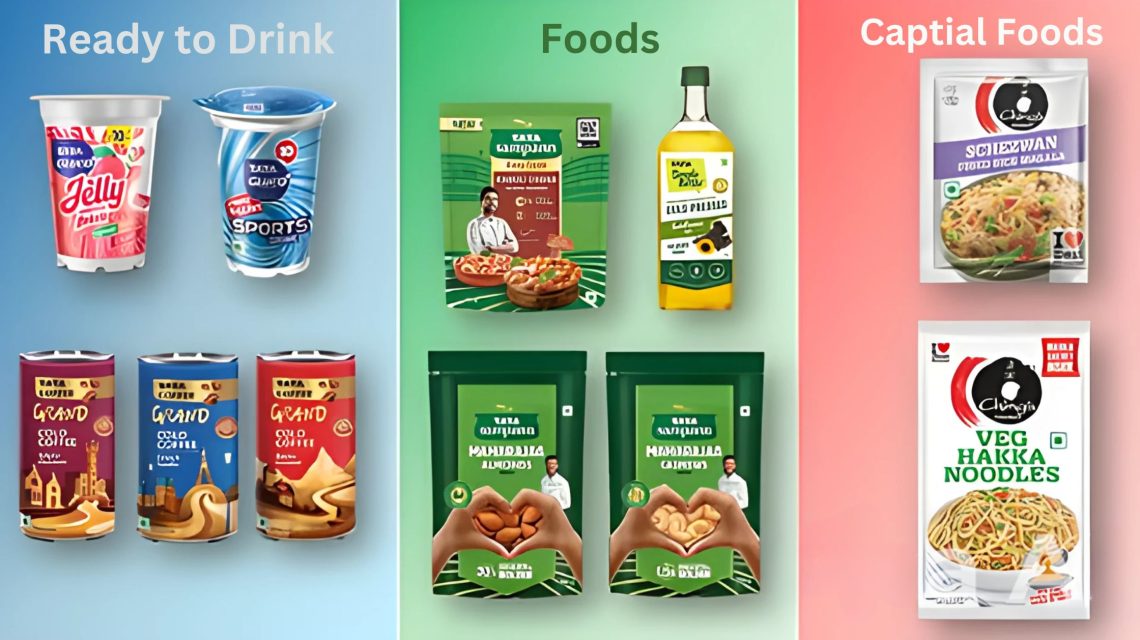

- Focus on Premiumization: TCPL continues to focus on premiumizing its product portfolio across key segments, catering to evolving consumer preferences and driving higher margins.

- Expanding Distribution Reach: The company is actively expanding its distribution network, reaching a wider customer base and enhancing market penetration.

- Investing in Innovation: TCPL is investing in research and development to introduce innovative products and enhance its existing portfolio.

Management Outlook:

- Navigating Challenges: Management acknowledged the challenges posed by tea inflation and emphasized the company’s efforts to mitigate the impact through strategic pricing and cost optimization measures.

- Long-Term Growth: Despite the short-term challenges, management remains optimistic about the company’s long-term growth prospects, driven by strong consumer demand, expanding distribution, and a focus on innovation.

Analyst Views:

- Mixed Analyst Sentiment: Analysts expressed mixed views on the Q3FY25 results.

- Some analysts expressed concerns over the impact of tea inflation on profitability and revised their earnings estimates downwards.

- Other analysts remained optimistic about the company’s long-term growth potential and maintained a positive outlook.

Conclusion:

TCPL’s Q3FY25 results showcased a mixed performance. While strong topline growth demonstrated the company’s resilience and market position, profitability faced pressure due to rising input costs, particularly tea inflation. Despite these challenges, TCPL’s strategic focus on premiumization, distribution expansion, and innovation positions it for long-term growth in the dynamic Indian FMCG market.

Stock to Buy Today :- Tata Consumer Products (₹983.25) – A Strong BUY Recommendation…

Stock to Buy Today :- Tata Consumer Products (₹983.25) – A Strong BUY Recommendation…